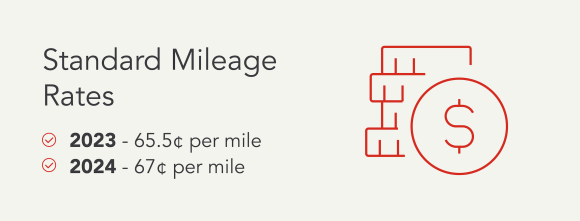

Business Miles Deduction 2024 Tax – T axpayers who claim the standard mileage rate deduction for the miles they log for business purposes will be able to write off 67 cents per mile in 2024, the IRS recently announc . Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the .

Business Miles Deduction 2024 Tax

Source : accountants.sva.comStandard Business Mileage Rate Increasing in 2024

Source : www.smolin.comSelf Employed Worker Mileage Deduction Guide (2024 Update)

Source : triplogmileage.comSelf Employed Tax Deductions Calculator 2023 2024 Intuit

Source : blog.turbotax.intuit.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comBusiness mileage tax deduction rate goes up, medical and moving

Source : www.dontmesswithtaxes.comIRS Announces Increased Business Mileage Rate for 2024

Source : www.driversnote.comIRS Mileage Rate for 2023 2024 | Moneywise

Source : moneywise.comThe standard business mileage rate will be going up slightly in

Source : www.bmcaccounting.comIRS Bumps Business Vehicle Tax Deduction to 67 Cents Per Mile in

Source : www.theepochtimes.comBusiness Miles Deduction 2024 Tax Standard Business Mileage Rate Going up Slightly in 2024: With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s . If you’re a business owner, don’t overlook some of these easy small business tax deductions that could help improve your bottom line. .

]]>